The Top Attributes to Try To Find in a Secured Credit Card Singapore

The Top Attributes to Try To Find in a Secured Credit Card Singapore

Blog Article

Charting the Course: Opportunities for Charge Card Access After Insolvency Discharge

Browsing the globe of credit score card gain access to post-bankruptcy discharge can be a daunting job for people looking to reconstruct their monetary standing. From secured credit history cards as a tipping stone to potential paths leading to unsecured credit scores possibilities, the trip towards re-establishing creditworthiness needs careful consideration and notified decision-making.

Understanding Credit Rating Fundamentals

Understanding the fundamental concepts of credit report is essential for individuals seeking to browse the complexities of economic decision-making post-bankruptcy discharge. A debt rating is a numerical representation of a person's credit reliability, indicating to loan providers the degree of risk related to extending credit. Several elements add to the calculation of a credit history, consisting of repayment history, amounts owed, length of credit rating, new credit scores, and types of credit rating utilized. Payment background holds significant weight in determining a credit report, as it reflects an individual's capacity to make prompt repayments on exceptional financial obligations. The quantity owed about readily available credit, also called credit score use, is an additional vital element influencing credit history. In addition, the length of credit background showcases a person's experience taking care of debt in time. Understanding these crucial components of credit report empowers people to make informed financial choices, reconstruct their credit score post-bankruptcy, and work towards attaining a much healthier monetary future.

Secured Credit Scores Cards Explained

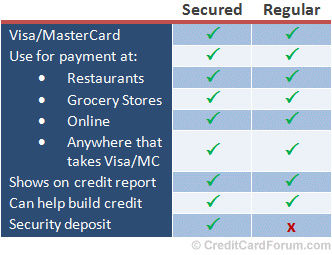

Secured charge card offer an important economic device for individuals looking to restore their credit rating adhering to a personal bankruptcy discharge. These cards need a down payment, which normally identifies the credit line. By utilizing a protected charge card properly, cardholders can show their credit reliability to prospective loan providers and slowly boost their credit report.

Among the essential advantages of safeguarded bank card is that they are more obtainable to individuals with a minimal credit report or a tarnished credit report - secured credit card singapore. Since the credit line is secured by a down payment, companies are a lot more going to authorize candidates that might not certify for typical unprotected bank card

Charge Card Options for Rebuilding

When seeking to restore credit score after bankruptcy, discovering different credit card choices customized to individuals in this financial scenario can be useful. Safe debt cards are a prominent choice for those looking to restore their debt. One more alternative is coming to be a licensed user on someone else's credit scores card, permitting people to piggyback off their credit report history and possibly boost their own rating.

How to Receive Unsecured Cards

To receive unsecured credit rating cards post-bankruptcy, people need to demonstrate improved creditworthiness via accountable financial monitoring and a background of on-time repayments. One of the primary actions to get approved for unprotected credit scores cards after bankruptcy is to continually pay bills promptly. Prompt payments showcase obligation and integrity to possible financial institutions. Keeping low charge card balances and avoiding building up linked here high degrees of financial debt post-bankruptcy also boosts creditworthiness. Monitoring credit rating reports consistently for any type of errors and disputing errors can additionally improve credit rating, making people more appealing to bank card companies. In addition, individuals can take into consideration looking for a protected charge card to reconstruct credit rating. Secured bank card require a cash down payment as collateral, which decreases the risk for the company and permits people to show liable credit report card usage. With time, accountable financial routines and a favorable credit report can bring about certification for unsecured charge card with much better benefits and terms, aiding people rebuild their monetary standing post-bankruptcy.

Tips for Accountable Charge Card Usage

Building on the foundation of boosted credit reliability developed through liable monetary monitoring, individuals can boost their general economic health by implementing essential pointers for accountable bank card usage. To start with, it is crucial to pay the complete statement equilibrium in a timely manner monthly to avoid gathering high-interest charges. Setting up automated repayments or suggestions can assist make sure timely payments. Second of all, tracking costs by routinely keeping track of charge card try this out declarations can stop overspending and aid identify any type of unauthorized deals immediately. Additionally, keeping a reduced credit scores use proportion, preferably below 30%, demonstrates responsible debt usage and can favorably influence credit report. Preventing cash money breakthroughs, which frequently include high charges and rate of interest, is also a good idea. Last but not least, avoiding opening multiple brand-new credit card accounts within a short duration can prevent prospective credit history damage and extreme financial debt accumulation. By sticking to these tips, individuals can utilize bank card efficiently to rebuild their monetary standing post-bankruptcy.

Verdict

In conclusion, people who have actually declared insolvency can still access bank card with various choices such as safeguarded debt cards and restoring credit report (secured credit card singapore). By recognizing credit rating basics, receiving unprotected cards, and exercising liable you could try here bank card use, individuals can slowly rebuild their creditworthiness. It is essential for people to thoroughly consider their financial circumstance and make educated choices to improve their credit rating standing after personal bankruptcy discharge

Numerous aspects add to the computation of a credit scores rating, consisting of repayment background, amounts owed, length of credit rating history, brand-new credit report, and types of credit history utilized. The amount owed family member to readily available credit report, likewise known as credit report utilization, is another essential element affecting credit history ratings. Keeping an eye on credit history records routinely for any kind of errors and disputing inaccuracies can additionally enhance credit history ratings, making people much more appealing to credit history card companies. Additionally, preserving a reduced credit application ratio, ideally listed below 30%, shows accountable credit score use and can positively influence credit rating scores.In conclusion, individuals who have submitted for insolvency can still access debt cards with various choices such as secured credit history cards and reconstructing debt.

Report this page